INCOME TAX RETURN

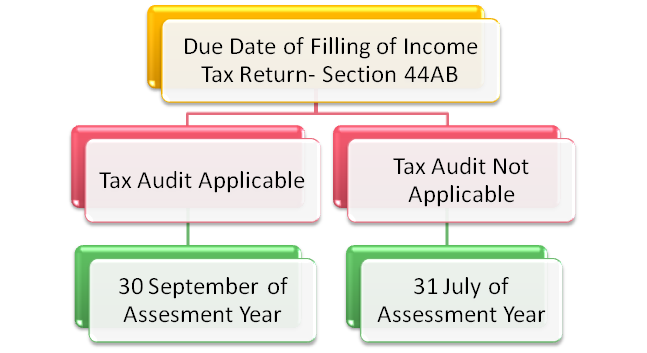

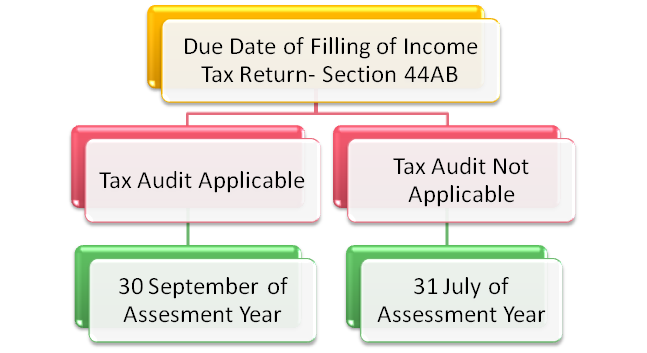

Every LLP have to file the Income Tax return with the Income Tax Authorities. Filing of returns is mandatory whether the LLP has started any business or not. Date of Filling of Tax Audit is as given Here:

For a Limited Liability Partnership (LLP), regular filing of returns is essential to uphold LLP compliance standards and steer clear of substantial penalties for non-compliance. LLPs benefit from a relatively lighter annual compliance burden compared to private limited companies. Nevertheless, the potential fines for non-compliance can be significant. While a Private Limited company might face penalties of INR 1 lakh for non-compliance, LLPs could incur penalties of up to INR 5 lakh. At IndiaFilings, we understand the critical importance of adhering to these annual compliances of LLP requirements, and our services are tailored to assist LLPs in meeting their obligations efficiently and effectively.

Limited Liability Partnerships (LLPs) are recognized as separate legal entities, and therefore, they are bound by specific compliance obligations. The responsibility for ensuring compliance rests with the Designated Partners of the LLP. The key LLP compliance requirements for LLPs include the following:

LLPs are required to file an annual return with the Ministry of Corporate Affairs for each financial year. This annual return is submitted using Form 11, and it provides essential information. This form gathers essential details about the LLP, including the total number of designated partners, comprehensive partner information, contributions received by partners, and a summary of all partners involved.

All LLPs are required to submit Form 11 within 60 days after the conclusion of the financial year. This means that Form 11 should be filed by May 30th each year.

It's crucial for LLPs to adhere to this deadline, as failure to do so can have consequences. One significant implication is that an LLP will not be permitted to close or wind up its operations until it has filed all its annual returns, including Form 11.

In the event that an LLP neglects to submit its LLP annual filing forms within the stipulated timeframe, it will incur a penalty of Rs.100 for each day of delay performed.

The penalty will be applicable from the due date of filing the return and will continue until the actual return is filed.

The benefits of LLP annual compliance are listed as follows:

Every LLP have to file the Income Tax return with the Income Tax Authorities. Filing of returns is mandatory whether the LLP has started any business or not. Date of Filling of Tax Audit is as given Here:

| S. No. | Agenda | Particulars | e-forms |

|---|---|---|---|

| 1 | Books of Account | LLP should Maintain proper Books of Account. | N.A. |

| 2 | Minutes Book | Minute’s book should be maintained to record minutes of meeting of partner and managing/ executive Committee of partners. | N.A. |

| 3 | Change in Partner | Any change in partner and designated partner (admission, resignation, cessation, death, expulsion) should be filed electronically within 30 days of change. | Form- 4 |

| 4 | Supplementary LLP Agreement | Such admission and cessation will alter mutual right and duties of partner shall change. Hence, supplementary LLP Agreement will be required to file within 30 days of change. | From-3 |

| 5 | Heavy Penalty | Heavy penalty of Rs. 100/- per day late filling of Return | N.A. |

| 6 | Change in Name | Any change in Name of LLP should be filed electronically within 30 days of change. | Form-5 |

| 7 | Change in Registered Office | Any change in place of registered office of LLP should be filed electronically within 30 days of change. | Form- 15 |

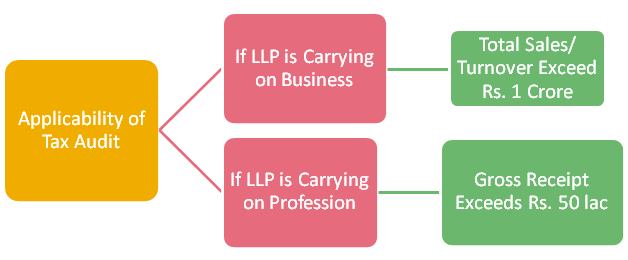

As per Section 44AB of Income Tax Act -1961

The following documents must be attached with Form 8:

Form 8 is a form and hence must be digitally signed by a minimum of two Designated

Partners of LLP or Authorised Representatives of Foreign LLP if the total turnover

of the LLP is less than or equal to Rs 40 lakh or partner’s obligation of

contribution is less than or equal to Rs 25 lakh.

In case the total turnover of the LLP exceeds Rs 40 lakh or partner’s obligation of

contribution exceeds Rs. 25 lakh, then Form 8 must be certified by the auditor of

the LLP/ FLLP.

Don’t worry!! Our expert will help you to choose a best suitable plan for you. Get in touch with our team to get all your queries resolved. Write to us at info@finxurance.com or call us @+91 9643 203 209.